Salem Health physician benefits

Starting on the first of the month, following your start date, Salem Health offers a wide range of benefits to support your family inside and outside of work.

*The following applies to staff working 20 hours or more per week and the below benefits are effective from January 1, 2024 – December 31, 2024.

*The intent of the benefit information noted on this page is to provide a brief summary of benefits offered and does not reflect all plan information.

Medical plans

You have a choice of three health plan options to cover yourself and your dependents. Each option provides comprehensive medical benefits, coverage for prescription drugs and free in-network preventive care. An in-network provider means a provider who is employed by Salem Health, West Valley Hospital or participating in Moda Health’s Connexus network.

Prime - High Deductible Plan

Network: Connexus

Administrator: Moda Health

Coinsurance: 20%

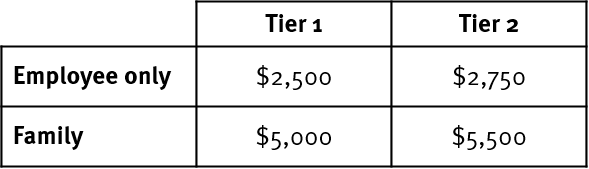

Deductible:

Option to be paired with an employer funded Health Savings Account (HSA)*. You can also contribute to the HSA to save for health care expenses and lower your taxable income.

Depending on who you cover, Salem Health contributes up to the following amount toward your HSA:

- Up to $1,600/employee only

- Up to $3,200/ family

*Prorated employer contribution applies for all HSA enrollment 02/01/24 – 12/01/24

Out-of-pocket maximums:

Prescription drugs:

After you have met your deductible:

- You pay 30% for Tier 1 (generic and preferred brands)

- You pay 40% for Tier 2 (generic and preferred brands)

Premiums*:

Classic - Medical Home Plan

Network: Connexus

Administrator: Moda Health

Coinsurance: Ranges between 20% and 40% depending on services

Deductible:

Option to be paired with a Flexible Spending Account (FSA), which allows you to use pre-tax dollars to pay for health care expenses. You can make pre-tax contributions of up to $3,050 per year.

Out-of-pocket maximum:

Prescription drugs:

Premiums*:

Choice - Medical Home Plan

Network: Connexus

Administrator: Moda Health

Coinsurance: Ranges between 10% and 20% depending on services

Deductible:

Option to be paired with a Flexible Spending Account (FSA), which allows you to use pre-tax dollars to pay for health care expenses. You can make pre-tax contributions of up to $3,050 per year.

Out-of-pocket maximum:

Prescription drugs:

Premiums*:

Dental plans

You have the choice of a Dental only plan OR a Dental + Orthodontia plan to fit you and your family's needs. Preventative services (cleanings and regular exams) are covered 100% and the deductible does not apply.

Dental only plan

Network: Delta Dental Premier Network

Administrator: Delta Dental

Annual deductible: $25 individual | $75 family

Basic services: 80% after deductible

Major services: 50% after deductible

Premiums*:

Dental plus orthodontia plan

Network: Delta Dental Premier Network

Administrator: Delta Dental

Annual deductible: $25 individual | $75 family

Basic services: 80% after deductible

Major services: 50% after deductible

Orthodontia: 50% to lifetime maximum of $1,500 per person

Premiums*:

Vision plan

Employees have two vision plans to choose from, Vision Basic or Vision Premium. You can choose to get covered for the essentials with the Vision Basic Plan or upgrade to the new enhanced Vision Premium Plan with annual benefits, increased allowances for frame and contact lenses, and VSP LightCare.

Basic - vision

Network: VSP Choice Network

Administrator: VSP

Copays:

- Exams: $20 copay for in–network providers.

- Prescription lenses (single vision, bifocals, trifocals) $ 20 copay in-network.

- Standard progressive lenses - $0; Premium and custom available at a discounted rate.

- Contacts: Fit & Follow-up – up to $60 copay and contacts plan pays up to $150/calendar year for in – network

Premiums*:

Premium - vision

Network: VSP Choice Network

Administrator: VSP

Copays:

- Exams: $20 copay for in–network providers.

- Prescription lenses (single vision, bifocals, trifocals) $ 20 copay in-network.

- Standard progressive lenses - $0; Premium and custom available at a discounted rate.

- Contacts: Fit & Follow-up – up to $60 copay and contacts plan pays up to $250/calendar year for in – network

Premiums*:

Life and accidental death and dismemberment insurance

- Salem Health provides Basic Life Insurance and Accidental Death and Dismemberment, fully paid by the hospital equal to 3x your base annual salary, up to a maximum of $1,500,000.

- Salem Health offers additional Voluntary Life Insurance, for yourself, spouse, and/or children. This is an employee paid benefit. As a newly benefit eligible employee you can elect up to the guaranteed issue amounts without having to complete evidence of insurability (EOI). The maximum coverage amount is $600,000, and the spouse can have equal to or less than the employee coverage amount.

- Secure Travel Benefit offering pre-trip planning, assistance while traveling and emergency medical transportation benefits when traveling 100 miles or more from home.

Mental health

- A set number of free counseling sessions each year either face to face, or over the phone for any Salem Health employee or household member, through Modern Health.

- Meru Health through Moda offers 12-week therapy programs right from your mobile device designed to improve your long-term mental health by treating anxiety, depression, and job burnout. The initial evaluation call is subject to member cost-share. After the initial evaluation call, this program is available at zero cost to members.

Dependent Care FSA

• You can enroll in the Dependent Care Flexible Spending Account to pay for eligible child and elder care expenses on a pre-tax basis (Annual maximum of $5,000).

Family support (people and pets)

- Salem Health provides you with access to Childcare, Elder, Pet Care referrals and assistance, through Modern Health.

- Salem Health provides you access to discounted Pet Insurance, new pet parent resources and bereavement support through Modern Health.

- New parents and foster parents may receive an $80 Amazon Voucher to purchase a variety of eligible items for the new member of the family.

- If you are adopting a child, you may be eligible for financial support under our adoption assistance program.

- When you have a sick child, you can access Salem Health’s onsite care services so you can be sure they are receiving quality care while you are at work.

Legal services

Eligible for one initial 30-minute office or telephone consultation at no cost with a Canopy Network Attorney. A preferred rate reduction of 25% from the attorney’s usual fee is available thereafter. Salem Health provides you access to legal consultation and resources through Modern Health.

Education reimbursement programs

- Salem Health supports your educational goals by offering financial assistance for certain educational programs.

- For approved roles, a bonus may be granted for certifications and professional achievements supporting relevant clinical excellence.

- Continuing Medical Education reimbursement for providers.

Disability (short term and long term)

- Salem Health offers employer paid Short Term Disability of 100% salary continuation for up to 180 days.

- Salem Health offers employer paid Long Term Disability and it pays 60% of your monthly covered earnings. Maximum benefit per month is $15,000.

Retirement savings plans

401(k) plan | Shared cost

Employee contributions

- Eligible upon entry into a benefits-eligible status

- Employee may contribute up to 70% of their income to IRS maximums

- Employees working more than 8 hours a week (PN status and above) will be auto enrolled at 5%, approx 35 days after DOH.

Matching contributions

- After completing one year of service, and you are deferring at least 1% into your 401(k), you will begin receiving an Employer Match Contribution on the pay period following your anniversary.

- Match contributions are 100% vested.

Experience contributions

- After completing one year of service in a benefits eligible position you become eligible for an experience contribution when you are deferring at least 1% into your 401(k).

- Experience Contributions are 20% vested per year for 5 years.

457(b) plan | Employee paid

- Deferred Compensation Plan for Executives and Physicians to offer additional retirement savings opportunity, through pre-tax contributions.

457(f) plan | Employer paid

- Eligibility – must be .5 FTE or above and minimum base salary of $275,000.

- Deferred Compensation Plan for Executives and Physicians funded with 4% of annual earnings.

- Class year accounts are setup with 4 year cliff vesting period.